Monetary Unit Sampling

for Internal Auditors

About Sampling

In auditing, sampling means applying testing procedures to less than 100% of the population and assess certain characteristics of the sample to support the audit conclusions

Non Statistical Sampling

Probably the most common audit sampling technique. The audit team selects a sample based on its professional judgement instead of applying a rigorous mathematical approach.

Statistical Samplings

It is a structured approach based on probabilistic calculations which allows the audit team to draw conclusion on the entire population on the basis of the examined sample

Why use a statistical sampling approach like MUS?

MUS enables auditors to evaluate the accuracy of monetary values within a population with confidence. By employing statistical sampling techniques, auditors can define appropriate sample sizes, measure sampling risk, and draw reliable conclusions about the accuracy of financial data. MUS provides a structured approach that ensures audit resources are utilized efficiently while maintaining rigorous audit standards.

Monetary Unit Sampling (MUS)

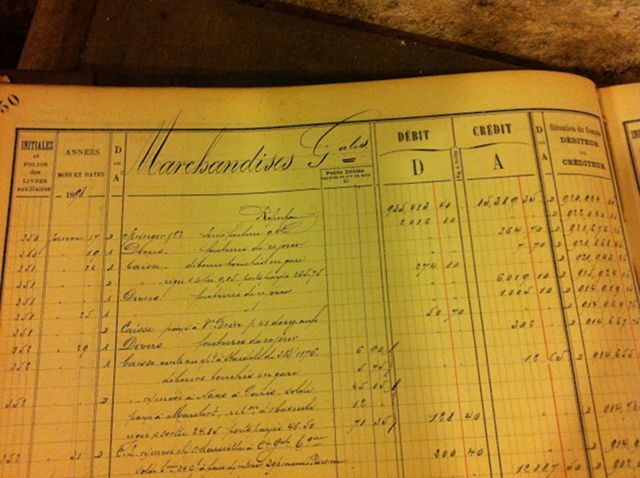

Monetary Unit Sampling (MUS) is a statistical sampling technique used to test the accuracy of monetary values within a population. It is particularly valuable when auditing financial statements, where precision and reliability are paramount. MUS offers auditors a systematic and efficient way to assess the accuracy of financial data while managing sampling risk effectively.

Sampling tools and resources available for MUS in this site:

The MUS tool in this site enables user to automate to the maximum possible extent the sampling process. Download an exel file containing the accounting entries and the tool will compute the sampling size and extract the sample data. Once completed the audit tests on the sampled entries, the system will compute the results and estimate the maximum potential error in the whole book.

As a bonus, you can use a Materiality Calculator to compute the materiality threshold for the book you are auditing, offering three different algorithms:

- Zero Error Assumption: Small samples

- Standard: Medium samples

- Conservative: Large samples

Sampling Wizards:

- Sampling Technique Wizard

- Sample Selection Wizard

- Sampling Process Wizard

The sampling Process Wizard will guide you through all the necessary steps to swiftly perform your sampling process.